TABLE OF CONTENTS

MEETINGS OF THE BOARD OF DIRECTORS

The board of directors has responsibility for establishing broad corporate policies and reviewing our overall performance rather than day-to-day operations. The board of

directors'directors’ primary responsibility is to oversee the management of Genpact and, in so doing, serve the best interests of the Company. Subject to the recommendations of the compensation committee and the nominating and governance committee, respectively, the board of directors selects, evaluates and provides for the succession of executive officers, and the board of directors nominates for election at annual general shareholder meetings individuals to serve as directors of Genpact and elects individuals to fill any vacancies on the board of directors to the extent not filled by shareholders in general meetings. The board of directors reviews and approves corporate objectives and strategies, and evaluates significant policies and proposed major commitments

| |

| 2021 Proxy Statement |5

|

of corporate resources. Management keeps the directors informed of Company activity through presentations at board of directors and committee meetings.

The board of directors met, in person or telephonically,

14ten times in

2020.2022. During

2020, each2022, all of our directors attended

75% or moreat least 84%, and an average of 89%, of the total number of meetings of the board of directors and the committees of which such director was a member during the period of time he or she served on such committee. Our Corporate Governance Guidelines set forth our policy that directors are expected to attend annual general meetings of shareholders. All of our directors

standing for re-election at the 2021 annual meeting who were serving on our board of directors at the time of the 2020 annual meeting attended the

20202022 annual meeting.

COMMITTEES OF THE BOARD OF DIRECTORS

The board of directors has standing audit, compensation and nominating and governance committees. Each committee has a charter that has been approved by the board of directors. Each committee must review the appropriateness of its charter and perform a self-evaluation at least annually. Mr. Tyagarajan is the only director who is an employee of Genpact, and he does not participate in any meeting, or portions of any meeting, at which his compensation or performance is evaluated. All members of all committees are non-employee directors and the board of directors has determined that all of the members of our three standing committees are independent as defined under the rules of the NYSE, and, in the case of all members of the audit committee, the independence requirements contemplated by Rule 10A-3 under the Securities Exchange Act of 1934, as

amended.amended (the “Exchange Act”).

The table below sets forth the committees of our board, the composition of each committee and the number of meetings of each committee during

2020. | | BOARD COMMITTEES |

Board Member | | Audit | | Compensation | | Nominating and

Governance |

Ajay Agrawal | | | | | | Member |

Stacey Cartwright | | Member | | | | |

Laura Conigliaro | | Member | | | | Member |

Carol Lindstrom | | | | Member | | Chair |

James Madden(1) | | | | Member | | Member |

CeCelia Morken | | Member | | Member | | |

Mark Nunnelly | | | | Chair | | |

Brian Stevens | | Member | | | | |

Mark Verdi(2) | | Chair | | | | |

Number of meetings in 2020 | | 9 | | 7 | | 5 |

| | Ajay Agrawal | | | | | | | | | Member | |

| | Stacey Cartwright | | | Member | | | | | | | |

| | Laura Conigliaro | | | Member | | | | | | Chair | |

| | Tamara Franklin | | | Member | | | | | | Member | |

| | Carol Lindstrom | | | | | | Chair | | | Member | |

| | James Madden(1) | | | | | | Member | | | Member | |

| | CeCelia Morken | | | Member | | | Member | | | | |

| | Brian Stevens | | | Member | | | | | | | |

| | Mark Verdi(2) | | | Chair | | | | | | | |

| | Number of meetings in 2022 | | | 9 | | | 6 | | | 3 | |

(1)

| (1)

| Mr. Madden currently serves as ChairmanChair of the board of directors. |

(2)

| (2)

| Audit committee financial expert as defined by SEC rules. |

TABLE OF CONTENTS

The tables below set forth the primary responsibilities of each committee of our board. The lists of responsibilities set forth below are not exhaustive. A complete list of each

committee'scommittee’s responsibilities can be found in the charter for each committee, available on our website,

www.genpact.com.

6 |2021 Proxy Statement

|

|

Audit Committee

| |

MEMBERS(1)

Mark Verdi (Chair)(2)

Tamara Franklin

Brian Stevens | PRIMARY RESPONSIBILITIES

| | • Appointing, approving the compensation of, and assessing the independence of our registered independent public accounting firm.

• the performance of any registered public accounting firm employed by us to provide audit services, including such firm'sfirm’s qualifications and independence;

• the quality and integrity of our accounting and reporting practices and controls, including our financial • the performance of our internal audit function; and

• our compliance with legal and regulatory requirements.

• Preparing an audit committee report as required by the SEC to be included in our annual proxy statement.

• Approving, in advance, any audit and any permissible non-audit services to be provided by our independent external audit firm.

• Reviewing and discussing with management our major financial, data privacy and cybersecurity and other significant risk exposures and the steps management has taken to monitor and control such exposures.

• Reviewing the Company’s policies and procedures for reviewing and approving related party transactions and recommending changes in such policies and procedures to our board of directors, and reviewing and approving related party transactions.

• Overseeing our compliance program andadherence to our Code of Conduct and investigating any matters that arise relating to the integrity of management.

• Establishing procedures for the receipt, retention and treatment of complaints regarding accounting, internal accounting controls or auditing matters and the confidential, anonymous submission by our employees of concerns regarding questionable accounting or auditing matters.

• Investigating any matter brought to its attention within the scope of its duties and retaining counsel for this purpose where appropriate.

• Reporting regularly to our full board of directors with respect to the foregoing. | |

(1)

| (1)

| The board has determined that each member of the audit committee meets the financial literacy and independence requirements of the SEC and the NYSE applicable to audit committee members. |

(2)

| (2)

| The board has determined that Mr. Verdi has been determined to beis an "audit“audit committee financial expert,"” as such term is defined in Item 407(d)(5) of Regulation S-K, and to havehas accounting or related financial management expertise as required by the NYSE listing standards. |

(3)

| The audit committee was established in accordance with section 3(a)(58)(A) of the Exchange Act. |

TABLE OF CONTENTS

Compensation Committee

MEMBERS(1)

Mark Nunnelly (Chair)

| CeCelia Morken | PRIMARY RESPONSIBILITIES

| | • Reviewing our compensation practices and policies, including equity plans.

• Overseeing the risks associated with the Company’s compensation policies and practices, and reviewing whether such policies and practices are reasonably likely to have a material adverse effect on the Company.

• Conducting an annual review and evaluation of our CEO; reviewing and approving compensation for our CEO and senior executives.executive officers.

• Reviewing and consulting with our CEO concerning selection of executive officers, performance of individual senior executivesexecutive officers and related matters.

• Overseeing the succession plans for our CEO and senior management.executive officers.

• Reviewing and approving compensation for our directors, including the ChairmanChair of the Board.

• Reviewing and discussing the management disclosures in our "Compensation“Compensation Discussion and Analysis"Analysis” and recommending to the board whether such disclosures shall be included in the appropriate regulatory filing.

• Overseeing our equity plans, incentive compensation plans and any such plans that the board may from time to time adopt and exercising all the powers, duties and responsibilities of the board of directors with respect to such plans.

• Preparing a compensation committee report for inclusion in our proxy statement.

• Reporting regularly to our full board of directors with respect to the foregoing. | |

(1)

| (1)

| The board has determined that each member of the compensation committee meets the independence requirements of the SEC and NYSE applicable to compensation committee members. |

| |

| 2021 Proxy Statement |7

|

Nominating and Governance Committee

MEMBERS(1)

| Laura Conigliaro (Chair)

Ajay Agrawal

Tamara Franklin

Carol Lindstrom (Chair)Ajay Agrawal

Laura Conigliaro

James Madden | PRIMARY RESPONSIBILITIES

| | • Making recommendations as to the size, composition, structure, operations, performance and effectiveness of our board of directors.

• Establishing criteria and qualifications for membership on our board of directors and its committees.

• Assessing and recommending to our board of directors strong and capable candidates with diverse experience and perspectives who are qualified to serve on our board of directors and its committees.

• Developing and recommending to our board of directors a set of corporate governance principles, including independence standards.

• Conducting an annual evaluation of our board of directors and our board committees.

• Overseeing environmental, social and governance (“ESG”) programs, activities and practices of the Company.

• Otherwise taking a leadership role in shaping our corporate governance.

• Reporting regularly to our full board of directors with respect to the foregoing. | |

(1)

| (1)

| The board has determined that each member of the nominating and governance committee meets the independence requirements of the SEC and NYSE applicable to nominating and governance committee members. |

TABLE OF CONTENTS

BOARD LEADERSHIP STRUCTURE

The positions of

ChairmanChair of the board of directors and CEO have historically been separated at Genpact. Keeping these positions separate allows our CEO to focus on our day-to-day business, while allowing the

ChairmanChair of the board of directors to lead the board in its exercise of business judgment to promote the long-term interests of our shareholders by providing strategic direction and overseeing management. The board of directors believes that keeping these positions separate is the appropriate leadership structure for us at this time.

ANNUAL BOARD, COMMITTEE AND INDIVIDUAL DIRECTOR EVALUATION PROCESS

As set forth in its charter, the nominating and governance committee oversees the board, committee and individual director evaluation process. Annually, the nominating and governance committee determines the appropriate form of evaluation and considers the design of the process to ensure it is both meaningful and effective.

From time to time, the board of directors engages an independent third party with experience in board evaluations and organizational effectiveness to lead the board evaluation. The last time the board engaged a third party to lead the board evaluation process was in 2019. In

2020,2022, the board led its own self-evaluation process, which included written evaluations of the board as a whole

each committee and individual directors and was led by the Chair of the nominating and governance committee. The process also included one-on-one interviews between the Chair of the nominating and governance committee and each other member of the board. The evaluation process engaged our directors on a wide range of topics, including board and committee structure, board dynamics and operations, and board, committee and individual director effectiveness and performance. Following the conclusion of the evaluation process, the board reviewed and discussed the evaluation

results and, in response, established certain agenda items for the board and its committees to act upon in 2021.results.

The results of the

20202022 evaluation process support the board’s belief that the board and its committees are operating effectively.

Our management is responsible for risk management on a day-to-day basis, and our board

and its committees overseeoversees the risk management activities of

management.management, which include our enterprise risk management program and the risks highlighted through our annual risk assessment process. The

board’s risk oversight responsibilities are fulfilled both by the board directly, as well as by its committees, each of which assists the Board in overseeing a part of the Company’s overall risk management agenda. As more fully described below, the audit committee assists the board in fulfilling its oversight responsibilities with respect to risk management in the areas of

data privacy, financial reporting, cybersecurity, internal controls and compliance with legal and regulatory requirements, and, in accordance with NYSE requirements, discusses policies with respect to risk assessment and risk management. The compensation committee assists the board in fulfilling its oversight responsibilities

| |

8 |2021 Proxy Statement

|

|

with respect to the management of risks arising from our compensation policies and programs and succession planning for our executive officers. The nominating and governance committee assists the board in fulfilling its oversight responsibilities with respect to the management of risks associated with board organization, membership and structure, succession planning for our directors, the Company’s ESG activities and corporate governance. For additional information on risks that affect our business, please see our most recent Annual Report on Form 10-K and other filings we make with the SEC.

OVERSIGHT OF ESG STRATEGY AND CYBERSECURITY AND DATA PRIVACY RISKS

As part of our board’s strategic and risk oversight, the board oversees our ESG strategies, including our sustainability priorities and human capital management practices and related risks. Throughout the year, the board receives periodic reports from management and the board’s committees on our ESG initiatives, overall sustainability strategy and the ESG reporting frameworks we use to track our progress. In 2022, our board delegated ESG oversight responsibility to the nominating and governance committee. Accordingly, the nominating and governance committee now oversees our overall ESG performance, disclosure, strategies, goals and objectives and monitors ESG risks and opportunities on behalf of the board. The board will also continue to monitor and receive periodic reports from the nominating and governance committee and management on these and other ESG matters, including with respect to human capital matters such as pay equity, inclusion and diversity, company culture and related risks.

10 2023 Proxy Statement | | | |

TABLE OF CONTENTS

As part of the board’s role in overseeing the Company’s enterprise risk management program, the board and the audit committee devote substantial time to monitoring cybersecurity and data privacy related risks. Our audit committee charter sets out the committee’s role in overseeing information technology risk exposures, including cybersecurity, data privacy and data security, and the audit committee receives quarterly reports on cybersecurity and data privacy matters and related risk exposures from management, including our Global Operating Officer, Chief Legal Officer and Chief Information Security Officer. The audit committee regularly updates the board on such matters and the board also periodically receives reports from management directly.

COMMUNICATING WITH THE INDEPENDENT DIRECTORS

The board of directors will give appropriate attention to written communications that are submitted by shareholders and other interested parties, and will respond if and as appropriate. The nominating and governance committee, with the assistance of the

Company'sCompany’s Chief Legal Officer, is primarily responsible for monitoring communications from shareholders and other interested parties and for providing copies or summaries to the other directors as its members consider appropriate. Our non-executive

Chairman,Chair, Mr. Madden, serves as the presiding director at all executive sessions of our non-management directors.

Communications will be forwarded to all directors if they relate to important substantive matters and include suggestions or comments that the nominating and governance committee considers to be important for the directors to know. In general, communications relating to corporate governance and corporate strategy are more likely to be forwarded than communications relating to ordinary business affairs, personal grievances and matters as to which the Company may receive repetitive or duplicative communications.

Shareholders and interested parties who wish to send communications on any topic to the board of directors should address such communications to:

521 Fifth Avenue,

of the Americas, 4th14th Floor

New York, New York

1003610175

Attention: Corporate Secretary

Our board of directors has adopted a code of conduct applicable to our directors, officers and employees in accordance with applicable rules and regulations of the SEC and the NYSE. The code is posted on our website at

www.genpact.com under the heading “Investors—Corporate

Governance.Governance—Highlights.” We will also provide a copy of the code to shareholders upon request. We disclose any material amendments to our code of conduct, as well as any waivers for executive officers or directors, on our website.

CERTAIN RELATIONSHIPS AND RELATED PARTY TRANSACTIONS

Our board of directors has adopted written policies and procedures for the review of any transaction, arrangement or relationship in which Genpact Limited is a participant, the amount involved exceeds $120,000, and one of our officers, directors, director nominees or 5% shareholders (or their immediate family members), each of whom we refer to as a

"related“related person,

"” has a direct or indirect material interest.

If a related person proposes to enter into such a transaction, arrangement or relationship, which we refer to as a "related“related person transaction,"” the related person must report the proposed related person transaction to our General Counsel. The policy calls for the proposed related person transaction to be reviewed prior to entry into the transaction and, if deemed appropriate, approved by the board'sboard’s audit committee. Whenever practicable, the reporting, review and approval will occur prior to entry into the transaction. If advance review and approval isour General Counsel becomes aware of a related person transaction that has not practicable,been reviewed by the audit committee, willthen the audit committee must review the transaction and, in its discretion, may ratify the related person transaction. The policy also permits the chair of the audit committee to review and, if deemed appropriate, approve proposed related person transactions that arise between committee meetings, subject to ratification by the audit committee at its next meeting.it. Any related person transactions that are ongoing in nature will be reviewed annually.

11 2023 Proxy Statement | | | |

TABLE OF CONTENTS

| Corporate Governance | |

| 2021 Proxy Statement |9

| |

A related person transaction reviewed under the policy will be considered approved or ratified if it is authorized by the audit committee after full disclosure of the related

person'sperson’s interest in the transaction. The audit committee will review and consider such information regarding the related person transaction as it deems appropriate under the circumstances.

The audit committee may approve or ratify the transaction only if the audit committee determines that, under all of the circumstances, the transaction is in,

or is not inconsistent with, the

Company's best interests.interests of the Company and its shareholders. The audit committee may impose any conditions on the related person transaction that it deems appropriate.

In addition to the transactions that are excluded by applicable SEC rules, the board has determined that the following transactions do not create a material direct or indirect interest on behalf of related persons and, therefore, are not related person transactions for purposes of this policy:

interests arising solely from the related personsperson’s position as an executive officer of another entity (whether or not the person is also a director of such entity) that is a participant in the transaction, where (a) the related person and all other related persons own in the aggregate less than a 10% equity interest in such entity, (b) the related person and his or her immediate family members are not involved in the negotiation of the terms of the transaction and do not receive any special benefits as a result of the transaction, (c) the amount involved in the transaction equals less than the greater of $1 million dollars or 2% of the annual gross revenues of the other entity that is a party to the transaction, and (d) the amount involved in the transaction equals less than 2% of our annual gross revenues; and

a transaction that is specifically contemplated by provisions of our charter or bye-laws.

We did not have any related person transactions with any of our executive officers or directors in 2020.2022.

12 2023 Proxy Statement | | | |

TABLE OF CONTENTS

| |

10 |2021 Proxy Statement

|

|

|

Security Ownership of Certain Beneficial Owners and Management | | | |

Security Ownership of Certain Beneficial Owners and Management The following table contains information regarding the beneficial ownership of our common shares as of March 12, 202110, 2023 by:

each shareholder we know to own beneficially more than 5% of our outstanding common shares;

each executive officer named in the 20202022 Summary Compensation Table; and

all of our director nominees and executive officers as a group.

Beneficial ownership is determined in accordance with the rules of the SEC and includes voting or investment power with respect to the securities. Common shares subject to options that are currently exercisable or are exercisable within 60 days of March

12, 202110, 2023 are deemed to be outstanding and beneficially owned by the person holding such options. Such shares, however, are not deemed to be outstanding for the purposes of computing the percentage ownership of any other person. Percentage of beneficial ownership is based on

187,149,112183,669,129 common shares of Genpact Limited outstanding on March

12, 2021. | | | | | | |

Name of Beneficial Owner(1) | | Number of Shares Beneficially Owned(2) | | Percentage of

Outstanding

Shares |

Known 5% Beneficial Owners |

FMR, LLC(3) | | 26,672,247 | | | 14.25 | % |

Wellington Management Group, LLP(4) | | 25,665,661 | | | 13.71 | % |

The Vanguard Group(5) | | 16,516,951 | | | 8.83 | % |

Brown Advisory Incorporated(6) | | 13,855,970 | | | 7.40 | % |

Nalanda India Equity Fund Limited(7) | | 13,143,983 | | | 7.02 | % |

| | | | |

Directors and Named Executive Officers |

N.V. Tyagarajan(8) | | 3,223,882 | | | 1.72 | % |

Edward J. Fitzpatrick(9) | | 322,409 | | | * |

Balkrishan Kalra(10) | | 292,390 | | | * |

Darren Saumur(11) | | 64,096 | | | * |

Kathryn Stein(12) | | 46,643 | | | * |

Ajay Agrawal(13) | | 11,212 | | | * |

Stacey Cartwright(14) | | 5,112 | | | * |

Laura Conigliaro(15) | | 49,230 | | | * |

Tamara Franklin | | — | | | * |

Carol Lindstrom(16) | | 18,079 | | | * |

James Madden(17) | | 20,604 | | | * |

CeCelia Morken(18) | | 27,774 | | | * |

Mark Nunnelly(19) | | 40,019 | | | * |

Brian Stevens(20) | | 5,112 | | | * |

Mark Verdi(21) | | 40,019 | | | * |

All Director Nominees and Executive Officers as a group (18 persons) | | 4,468,605 | | | 2.39 | % |

13 2023 Proxy Statement | ∗

| | |

TABLE OF CONTENTS

| Security Ownership of Certain Beneficial Owners and Management | | | |

| | FMR, LLC(3) | | | 18,683,945 | | | 10.17% | |

| | The Vanguard Group(4) | | | 16,741,780 | | | 9.12% | |

| | BlackRock, Inc.(5) | | | 15,507,019 | | | 8.44% | |

| | Wellington Management Group, LLP(6) | | | 14,000,573 | | | 7.62% | |

| | Nalanda India Equity Fund Limited(7) | | | 13,143,983 | | | 7.16% | |

| | Directors and Named Executive Officers

| |

| | N.V. Tyagarajan(8) | | | 3,252,560 | | | 1.77% | |

| | Michael Weiner(9) | | | 13,801 | | | * | |

| | Balkrishan Kalra(10) | | | 550,855 | | | * | |

| | Darren Saumur(11) | | | 108,985 | | | * | |

| | Kathryn Stein(12) | | | 172,911 | | | * | |

| | Ajay Agrawal(13) | | | 22,524 | | | * | |

| | Stacey Cartwright(14) | | | 15,662 | | | * | |

| | Laura Conigliaro(15) | | | 57,768 | | | * | |

| | Tamara Franklin(16) | | | 8,538 | | | * | |

| | Carol Lindstrom(17) | | | 15,197 | | | * | |

| | James Madden(18) | | | 34,582 | | | * | |

| | CeCelia Morken(19) | | | 36,312 | | | * | |

| | Brian Stevens(20) | | | 13,650 | | | * | |

| | Mark Verdi(21) | | | 48,557 | | | * | |

| | All Director Nominees and Executive Officers as a group (16 persons) | | | 4,808,131 | | | 2.62% | |

*

| Number of shares represents less than 1% of outstanding common shares. |

(1)

| (1)

| Unless noted otherwise, the business address of each beneficial owner is c/o Genpact Limited, Canon’s Court, 22 Victoria Street, Hamilton HM 12, Bermuda. |

(2)

| (2)

| Beneficial ownership is determined in accordance with the rules of the SEC and includes voting and/or investment power with respect to the shares shown as beneficially owned. |

(3)

| (3)

| Based solely on a Schedule 13G/A filed with the SEC on February 8, 2021.10, 2023. The business address of FMR, LLC is 245 Summer Street, Boston, MA 02210 02210. |

(4)

| (4)

| Based solely on a Schedule 13G/A filed with the SEC on February 3, 2021.9, 2023. The business address of The Vanguard Group is 100 Vanguard Blvd., Malvern, PA 19355. |

(5)

| Based solely on a Schedule 13G/A filed with the SEC on February 23, 2023. The business address of BlackRock, Inc. is 55 East 52nd Street, New York, NY 10055. |

(6)

| Based solely on a Schedule 13G/A filed with the SEC on February 6, 2023. The business address of Wellington Management Group, LLP is c/o Wellington Management Company LLP, 280 Congress Street, Boston, MA 02210. |

(7)

| |

| 2021 Proxy Statement |11

|

| (5)

| Based solely on a Schedule 13G/A filed with the SEC on February 10, 2021. The business address of The Vanguard Group is 100 Vanguard Blvd., Malvern, PA 19355.

|

| (6)

| Based solely on a Schedule 13G/A filed with the SEC on February 8, 2021. This amount includes 13,659,469 common shares beneficially owned by Brown Advisory, LLC, 188,993 common shares beneficially owned by Brown Investment Advisory and Trust Company and 7,508 common shares beneficially owned by Brown Advisory Limited. The business address of Brown Advisory Incorporated is 901 South Bond Street, Ste. 400, Baltimore, MD 21231.

|

| (7)

| Based solely on a Schedule 13G filed with the SEC on February 11, 2021. The business address of Nalanda India Equity Fund Limited is Lot 203A, 2nd Floor, Moka Business Center, Montagne Ory Road, Bon Air, Moka, Mauritius. |

(8)

| (8)

| This amount includes options to purchase 2,850,1782,733,106 shares that are exercisable within 60 days, 363,704519,454 shares held directly by Mr. Tyagarajan, and 10,000 shares held in trust for the benefit of Mr. Tyagarajan'sTyagarajan’s family members. |

(9)

| (9)

This amount includes 13,801 shares held directly by Mr. Weiner. |

(10)

| This amount includes options to purchase 250,000448,410 shares that are exercisable within 60 days and 72,409102,445 shares held directly by Mr. Fitzpatrick. Kalra. |

(11)

| (10)

| This amount includes options to purchase 207,28053,990 shares that are exercisable within 60 days and 85,11054,995 shares held directly by Mr. Kalra. Saumur. |

(12)

| (11)

| This amount includes options to purchase 35,000143,040 shares that are exercisable within 60 days and 29,096 shares held directly by Mr. Saumur. |

| (12)

| This amount includes options to purchase 25,000 shares that are exercisable within 60 days and 21,64329,871 shares held directly by Ms. Stein.

|

14 2023 Proxy Statement | | | |

TABLE OF CONTENTS

| Security Ownership of Certain Beneficial Owners and Management | | | |

(13)

| (13)

| This amount includes 6,10017,695 shares held directly by Mr. Agrawal and 5,1124,829 vested restricted share units, the shares underlying which will be issued on December 31, 2021. 2023. |

(14)

| (14)

| This amount includes 5,11210,833 shares held directly by Ms. Cartwright and 4,829 vested restricted share units, the shares underlying which will be issued on December 31, 2021. 2023. |

(15)

| (15)

| This amount includes 44,11852,939 shares held directly by Ms. Conigliaro and 5,1124,829 vested restricted share units, the shares underlying which will be issued on December 31, 2021. 2023. |

(16)

| (16)

| This amount includes 12,9673,709 shares held directly by Ms. LindstromFranklin and 5,1124,829 vested restricted share units, the shares underlying which will be issued on December 31, 2021. 2023. |

(17)

| (17)

| This amount includes 11,98710,368 shares held directly by Mr. MaddenMs. Lindstrom and 8,6174,829 vested restricted share units, the shares underlying which will be issued on December 31, 2021. 2023. |

(18)

| (18)

| This amount includes 22,66226,856 shares held directly by Ms. MorkenMr. Madden and 5,1127,726 vested restricted share units, the shares underlying which will be issued on December 31, 2021. 2023. |

(19)

| (19)

| This amount includes 34,90731,483 shares held directly by Mr. NunnellyMs. Morken and 5,1124,829 vested restricted share units, the shares underlying which will be issued on December 31, 2021. 2023. |

(20)

| (20)

| This amount includes 5,1128,821 shares held directly by Mr. Stevens and 4,829 vested restricted share units, the shares underlying which will be issued on December 31, 2021. 2023. |

(21)

| (21)

| This amount includes 34,90743,728 shares held directly by Mr. Verdi and 5,1124,829 vested restricted share units, the shares underlying which will be issued on December 31, 2021. 2023. |

15 2023 Proxy Statement | | | |

TABLE OF CONTENTS

| Director Nominees | |

12 |2021 Proxy Statement

|

| |

| | BOARD RECOMMENDATION:

The board of directors believes that approval of the election of all nominees set forth herein is in the Company’s best interests and the best interests of our shareholders and therefore recommends a vote FOR all of these nominees.

| |

ELECTION OF DIRECTORS

Our board of directors currently consists of

eleven members, including Tamara Franklin, who was appointed to serve on our board effective March 29, 2021.ten members. The nominating and governance committee of the board of directors has recommended to the board of directors, and the board of directors has nominated, the

eleventen persons whose biographies appear below for election as directors with terms expiring at the

20222024 annual meeting. Unless a contrary direction is indicated, it is intended that proxies received will be voted for the election as directors of the

eleventen nominees, each to serve for a one-year term until their successors are elected or the incumbent resigns. Each of the nominees has consented to being named in this

Proxy Statementproxy statement and to serve as a director if elected. In the event any nominee for director declines or is unable to serve, there will be a vacancy created on the board of directors, which the board of directors may fill on the recommendation of the nominating and governance committee.

Set forth below is certain biographical information as of the date of this proxy statement about each nominee for election to our board of directors, including information each nominee has given us about his or her age, his or her principal occupation and business experience for the past five years, and the names of other publicly held companies of which he or she has served as a director in the past five years. The information presented reflects the specific experience, qualifications, attributes and skills that led the board to conclude that each of these individuals is well-suited to serve on our board. Information about the number of common shares beneficially owned by each current director appears above under the heading “Security Ownership of Certain Beneficial Owners and Management.”

16 2023 Proxy Statement | | | |

TABLE OF CONTENTS

DIRECTOR PROFILES

| | | | | | | |

N.V. “Tiger” Tyagarajan | | James Madden, Chair

|

| |

| |

| | Director Since: 2005

Age: 59

INDEPENDENT

Committees: Nominating and Governance, Compensation

|

• President and Chief Executive Officer, Genpact (2011 to present)

• Chief Operating Officer, Genpact (2009-2011)

• Executive Vice President, Sales, Marketing, and Business Development, Genpact (2005-2009)

QUALIFICATIONS FOR BOARD SERVICE

• Extensive knowledge of our industry and business and service as our Chief Executive Officer. | |

| | James Madden, Chair

Director Since: 2005

Age: 61

INDEPENDENT

Committees: Nominating and

Governance, Compensation | | | • Co-founder and Co-CEO, Carrick Capital Partners, LLC (2012 to present)

• Founder, Managing Partner, Madden Capital Partners (2005-2012)

• Partner, Accretive LLC (2007-2011)

• Special Advisor, General Atlantic LLC (2005-2007)

• Chairman Chair and CEO, Exult, Inc. (1998-2005)

PAST PUBLIC COMPANY BOARDS

• ServiceSource International, Inc.

QUALIFICATIONS FOR BOARD SERVICE

• Extensive knowledge of our industry and experience serving on the boards of other public companies. | |

| | |

| 2021 Proxy Statement |13

|

| | | | | | |

| | | | | | |

Ajay Agrawal

| | Stacey Cartwright

|

| |

Committees: Nominating and

Governance | |

| | Director Since: 2019

Age: 57

INDEPENDENT

Committees: Audit

|

• Professor of Strategic Management, Rotman School of Management, University of Toronto (2003 to present)

• Founder and Academic Director, Creative Destruction Lab, Rotman School of Management (2012 to present)

• Founder, Brainmaven Corp. (October 2018 to present)

• Assistant Professor, Queens University (prior to 2003)

QUALIFICATIONS FOR BOARD SERVICE

• Extensive knowledge of and expertise in new technologies, including artificial intelligence, relevant to our strategic business plan. |

|

17 2023 Proxy Statement | | | |

TABLE OF CONTENTS

| | Stacey Cartwright

Director Since: 2019

Age: 59

INDEPENDENT

Committees: Audit | | | • Chief Executive Officer, Harvey Nichols Group Ltd (2014-2018)

• EVP and Chief Financial Officer, Burberry Group plc (2004-2013)

• Chief Financial Officer, Egg plc (1999-2003)

• Granada plc (various positions) (1988-1999)

• Pricewaterhouse UK (various positions) (1985-1988)

CURRENT PUBLIC COMPANY BOARDS

PAST PUBLIC COMPANY BOARDS

QUALIFICATIONS FOR BOARD SERVICE

• Experience leading and transforming, and serving as a director on the boards of, other public companies. | |

| | | | | | | |

Laura Conigliaro | | Tamara Franklin

|

| |

Committees: Audit, Nominating and Governance (Chair) | |

| | Director Since: 2021*

Age: 54

INDEPENDENT

|

• Partner, Co-director, America'sAmerica’s Equity Research Unit; Technology equity research business unit leader; Analyst, hardware systems sector, Goldman Sachs (1996-2011)

• Analyst, Prudential Securities (1979-1996)

PAST PUBLIC COMPANY BOARDS ●

QUALIFICATIONS FOR BOARD SERVICE

• Extensive knowledge of the financial services and technology industries and service on other public company boards. |

|

| | Tamara Franklin

Director Since: 2021

Age: 56

INDEPENDENT

Committees: Audit, Nominating and Governance | | | • Chief Digital, Data & Analytics Officer, Marsh LLC (2020 to present)2023)

• Chief Digital Officer/Vice President, Media & Entertainment, North America, IBM (2017-2020)

• Executive Vice President, Digital, Scripps Networks Interactive (2009-2016)

QUALIFICATIONS FOR BOARD SERVICE

• Extensive experience at large companies driving digital transformation initiatives across technology, data and analytics.* Ms. Franklin has been appointed to the Board effective March 29, 2021.

| |

18 2023 Proxy Statement | | | |

TABLE OF CONTENTS

| Director Nominees | |

14 |2021 Proxy Statement

|

| |

| | | | | | | |

| | | | | | |

Carol Lindstrom

| | CeCelia Morken

|

| |

Committees: Compensation

(Chair), Nominating

and Governance (Chair) | |

| | Director Since: 2016

Age: 63

INDEPENDENT

Committees: Audit, Compensation

|

• Vice Chairman, Deloitte LLP; President, Deloitte Foundation; Director, Deloitte & Touche LLP Board (1995-2016)

• Partner, Andersen Consulting

CURRENT PUBLIC COMPANY BOARDS

• ASGN Incorporated

PAST PUBLIC COMPANY BOARDS

QUALIFICATIONS FOR BOARD SERVICE

• Extensive experience in the fields of technology and consulting and service on other public company boards. |

|

| | CeCelia Morken

Director Since: 2016

Age: 65

INDEPENDENT

Committees: Audit,

Compensation | | | • President, Headspace Health and Former Chief Executive Officer, Headspace Inc. (January 2021 to present)•December 2021); President and Chief Operating OfficerCOO, Headspace Inc. (April 2020 to December 2020)

• Executive Vice President and General Manager, Strategic Partner Group, Intuit Inc. (2013 to 2020)•; General Manager, Intuit Financial Services Division, Intuit Inc. (2002-2013)

• Senior Vice President, WebTone Technologies (1999-2002)

• Senior Vice President, retail lending, Fortis Investments (1998-1999)

• Senior Vice President; various positions, John H. Hartland Co. (1983-1998)

CURRENT PUBLIC COMPANY BOARDS

• Alteryx, Inc.

• Wells Fargo & Company

QUALIFICATIONS FOR BOARD SERVICE

• Experience in finance and accounting, sales and marketing, new digital technologies and employee health, welfare and engagement. | |

| | | | | | | |

Mark Nunnelly

| | Brian Stevens |

| |

Committees: Compensation (Chair)Audit | |

| | Director Since: 2020

Age: 57

INDEPENDENT

Committees: Audit

|

• Chairman, AVALT Holdings (2018 to present)• Secretary, Executive Office of Technology Services and Security, Commonwealth of Massachusetts (2017 to 2018)

• Commissioner of Revenue, Commonwealth of Massachusetts (2015-2017)

• Managing Director, Bain Capital (1989-2014)

PAST PUBLIC COMPANY BOARDS

• Bloomin' Brands, Inc.

• Dunkin' Brands Group, Inc.

QUALIFICATIONS FOR BOARD SERVICE

• Extensive knowledge of the financial services industry and experience in finance and serving on the boards of other public companies.

|

| PROFESSIONAL EXPERIENCE

• Executive Chairman, Neural Magic (2019 to present)

• Vice President and Chief Technology Officer, Google Cloud (2014-2019)

• Chief Technology Officer and Executive Vice President of Worldwide Engineering, Red Hat, Inc. (2001-2014)

CURRENT PUBLIC COMPANY BOARDS

QUALIFICATIONS FOR BOARD SERVICE

• Experience as a chief technology officer and expertise in software engineering, cloud, open source, virtualization and machine learning. learning, and service on other public company boards.

| |

19 2023 Proxy Statement | | | |

TABLE OF CONTENTS

| Director Nominees | |

| 2021 Proxy Statement |15

| |

| | | | | | | |

| | | | | | |

Mark Verdi

| | |

| |

Committees: Audit (Chair) | | | | |

• Partner, AVALT Holdings (2015 to present)

• President, C&S Wholesale Grocers, Inc. (2014-2015)

• Managing Director, Bain Capital (2004-2014)

• Head of financial services business transformation outsourcing group, IBM Global Services (prior to 2004)

PAST PUBLIC COMPANY BOARDS

• Burlington Stores, Inc.

QUALIFICATIONS FOR BOARD SERVICE

• Extensive experience in our industry and in finance and accounting, and experience serving on the boards of other public companies. |

| |

There are no family relationships among any of the directors and executive officers of Genpact. No arrangements or understandings exist between any director or any person nominated for election as a director and any other person pursuant to which such person is to be selected as a director or nominee for election as a director.

20 2023 Proxy Statement | | | |

TABLE OF CONTENTS

| Director Compensation |

PROPOSAL 1 – ELECTION OF DIRECTORS

| | |

BOARD RECOMMENDATION: The board of directors believes that approval of the election of all nominees listed above is in the Company's best interests and the best interests of our shareholders and therefore recommends a vote FOR all of these nominees.Director Compensation | |

16 |2021 Proxy Statement

|

|

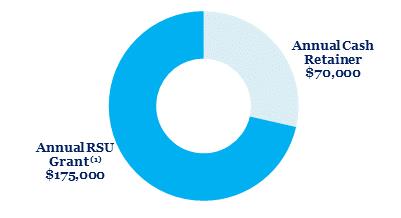

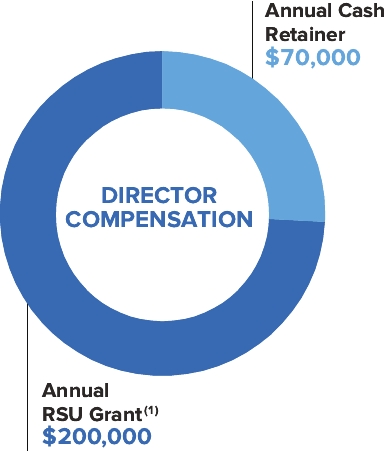

The compensation committee, which is comprised solely of independent directors, reviews and approves the compensation arrangements for our directors.

The committee reviews director compensation every other year.

In connection with its

20192021 review of director compensation, the compensation committee considered the results of an independent analysis on director compensation prepared by FW Cook, an independent, external compensation consulting firm. As part of this analysis, FW Cook reviewed non-employee director compensation trends and data from companies comprising the same executive compensation peer group used by the compensation committee in connection with its review of CEO compensation in

2018.2021. After considering the information contained in the FW Cook report, the compensation committee

recommended and the board approved the following changes to our director compensation program effective January 1,

20202022 to align director compensation levels

withinwith the

projected market median range:

Increased the base annual cash retainer for non-employee directors from $62,500 to $70,000;

Increased the committee chair retainers for the audit, compensation and nominating and governance committees by $5,000 annually;

EliminatedIncreased the sign-onvalue of the annual restricted share unit (“RSU”) grant with a value of $180,000, a one-time award previously granted to new non-employee directors upon joiningfrom $175,000 to $200,000.

The compensation committee believes that leaving the board;annual base cash retainer unchanged and

Increased allocating the valuetotal amount of the base director compensation increase to the annual RSU grant to non-employeeis appropriate because it more closely aligns our directors from $120,000 to $175,000.

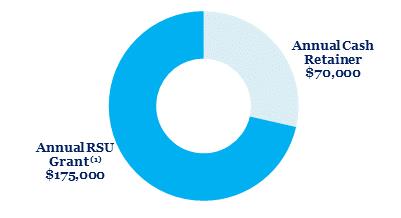

with our shareholders’ interests by rewarding directors for long-term shareholder value creation, and it also mirrors the emphasis in our executive compensation program on weighting equity more heavily than cash in setting total compensation targets. All other features of our director compensation program were left unchanged. The components of our 2020 non-employee director compensation are set forth below.

ELEMENTS OF

20202022 DIRECTOR COMPENSATION

Under our director compensation program, our non-employee directors received an annual retainer with a total value of

$245,000,$270,000, divided between cash and equity — in the form of an RSU grant — as depicted below.

(1)

| (1)

| Under our director compensation program, on the date of the 2022 annual general meeting of shareholders, our non-employee directors received a grant of RSUs with a value of $175,000$200,000 based on the closing price of the Company'sCompany’s common shares on the date of grant. Such RSUs vested on December 31, 2022 and the underlying shares will be issued at the end of 2023. |

21 2023 Proxy Statement | | | |

TABLE OF CONTENTS

| Director Compensation | | | |

In addition to an annual cash retainer and RSU grant, our non-employee directors receive the additional compensation below, as applicable. All cash retainers are paid in quarterly installments based on each director’s service on the board or a committee during such quarter.

| | Board Chair Retainer (annual) | | | $65,000 | |

| | Board Chair RSU Grant (annual)(1) | | | $120,000 in value of RSUs | |

| | Committee Chair Retainer (annual) | | | $47,500 for the Audit Committee Chair

$32,500 for the Compensation Committee Chair

$32,500 for the Nominating and Governance Committee Chair | |

| | Committee Membership Retainer (annual) | | | $22,500 for the Audit Committee

$17,500 for the Compensation Committee

$17,500 for the Nominating and Governance Committee | |

(1)

| For his service as Chair of the board of directors, in addition to the annual grant of RSUs to all non-employee directors, Mr. Madden received, on the date of the 2022 annual general meeting of shareholders, a grant of RSUs with a value of $120,000 based on the closing price of the Company’s common shares on the date of grant. Such RSUs vest on the last day of the calendar year of grant and the underlying vested shares are issued at the end of the subsequent year. |

| |

| 2021 Proxy Statement |17

|

In addition to an annual cash retainer and RSU grant, our non-employee directors receive the additional compensation below, as applicable. All cash retainers are paid in quarterly installments based on each director's service on the board or a committee during such quarter.

| |

Chairman Retainer (annual)(1)

| $65,000

|

Chairman RSU Grant (annual)(1)(2)

| $120,000 in value of RSUs

|

Committee Chair Retainer (annual)

| $42,500 for the Audit Committee Chair

$27,500 for the Compensation Committee Chair

$27,500 for the Nominating and Governance Committee Chair

|

Committee Membership Retainer (annual)

| $22,500 for the Audit Committee

$17,500 for the Compensation Committee

$17,500 for the Nominating and Governance Committee

|

| (1)

| In connection with the transition from Mr. Robert Scott to Mr. Madden as the Chairman of our board of directors in May 2020, the compensation committee reduced the annual Chairman cash retainer from $100,000 to $65,000 and the annual Chairman RSU grant from $150,000 to $120,000.

|

| (2)

| For his service as Chairman of the board of directors, in addition to the annual grant of RSUs to all non-employee directors, Mr. Madden received, on the date of the 2020 annual general meeting of shareholders, a grant of RSUs with a value of $120,000 based on the closing price of the Company's common shares on the date of grant. Such RSUs vest on the last day of the calendar year of grant and the underlying vested shares are issued at the end of the subsequent year.

|

Governance Features

Our non-employee director compensation program is subject to the following governance features:

| • | Limit on Director Compensation. The total annual limit on aggregate maximum compensation per non-employee director is $750,000. |

| • | Trading Windows. Our directors can only transact in our securities during approved trading windows after satisfying mandatory trade pre-clearance requirements. |

| • | Hedging/Pledging Prohibition. Our insider trading policy prohibits our directors from hedging or pledging our securities. |

| • | Share Ownership Requirement. Our non-employee directors are required to own a number of our common shares with a minimum value of three times their annual cash retainers. Each non-employee director has a five-year phase in period to meet the ownership requirements, measured from the later of the adoption of the Company’s share ownership guidelines in 2019 or the date of such director’s appointment to the board. After the initial phase-in period, each non-employee director is required to retain 100% of the shares issued upon the vesting of restricted share unit awards (net of any shares withheld or sold to cover withholding and other applicable taxes) until the multiple of annual cash retainer is reached. As of December 31, 2022, all of our non-employee directors were in compliance with the ownership requirement applicable to them. |

| • | Other Compensation. Our non-employee directors do not receive any non-equity incentive plan compensation, participate in any pension plans or receive non-qualified deferred compensation. We provide our directors with directors and officers liability insurance as part of our corporate insurance policies. We also reimburse our directors for reasonable travel and related expenses incurred in connection with their participation in board and committee meetings and other Company activities such as site visits or Company-sponsored events in which they participate as directors. |

Limit on Director Compensation. The total annual limit on aggregate maximum compensation per non-employee director is $750,000.

22 2023 Proxy Statement | | | |

Trading Windows. Our directors can only transact in our securities during approved trading windows after satisfying mandatory trade pre-clearance requirements.

Hedging/Pledging Prohibition. Our insider trading policy prohibits our directors from hedging or pledging our securities.

Share Ownership Requirement. Our non-employee directors are required to own a number of our common shares with a minimum value of three times their annual cash retainers.

Other Compensation. Our non-employee directors do not receive any non-equity incentive plan compensation, participate in any pension plans or receive non-qualified deferred compensation. We provide our directors with directors and officers liability insurance as part of our corporate insurance policies. We also reimburse our directors for reasonable travel and related expenses incurred in connection with their participation in board and committee meetings and other Company activities such as site visits or Company-sponsored events in which they participate as directors.

TABLE OF CONTENTS

| Director Compensation | |

18 |2021 Proxy Statement

|

| |

The following table sets forth the compensation of our non-employee directors for the fiscal year ended December 31,

2020. | | | | | | | | | | | | | | | |

Director | | Fees Earned or

Paid in Cash | | Stock Awards(1) | | All Other

Compensation | | Total |

A. AGRAWAL | | $ | 87,500 | | | $ | 174,984 | | | — | | | $ | 262,484 | |

S. CARTWRIGHT | | $ | 92,500 | | | $ | 174,984 | | | — | | | $ | 267,484 | |

L. CONIGLIARO | | $ | 103,269 | | | $ | 174,984 | | | — | | | $ | 278,253 | |

C. LINDSTROM | | $ | 104,423 | | | $ | 174,984 | | | — | | | $ | 279,407 | |

J. MADDEN | | $ | 148,846 | | | $ | 294,960 | | | — | | | $ | 443,806 | |

C. MORKEN | | $ | 103,269 | | | $ | 174,984 | | | — | | | $ | 278,253 | |

M. NUNNELLY | | $ | 97,500 | | | $ | 174,984 | | | — | | | $ | 272,484 | |

R. SCOTT | | $ | 87,500 | | | $ | — | | | $27,692(2) | | $ | 115,192 | |

B. STEVENS | | $ | 54,327 | | | $ | 174,984 | | | — | | | $ | 229,311 | |

M. VERDI | | $ | 112,500 | | | $ | 174,984 | | | — | | | $ | 287,484 | |

| | A. AGRAWAL | | | $ 87,500 | | | $199,969 | | | — | | | $287,469 | |

| | S. CARTWRIGHT | | | $ 92,500 | | | $199,969 | | | — | | | $292,469 | |

| | L. CONIGLIARO(2) | | | $119,231 | | | $199,969 | | | — | | | $319,200 | |

| | T. FRANKLIN(3) | | | $103,269 | | | $199,969 | | | — | | | $303,238 | |

| | C. LINDSTROM | | | $120,000 | | | $199,969 | | | — | | | $319,969 | |

| | J. MADDEN | | | $170,000 | | | $319,934 | | | — | | | $489,934 | |

| | C. MORKEN | | | $110,000 | | | $199,969 | | | — | | | $309,969 | |

| | M. NUNNELLY(4) | | | $ 39,423 | | | — | | | — | | | $39,423 | |

| | B. STEVENS | | | $ 92,500 | | | $199,969 | | | — | | | $292,469 | |

| | M. VERDI | | | $117,500 | | | $199,969 | | | — | | | $317,469 | |

(1)

| (1)

| The amounts shown under this column reflect the dollar amount of the aggregate grant date fair value of equity-based compensation awards granted during the year, calculated in accordance with Financial Accounting Standards Board Codification Topic 718, Compensation-Stock Compensation, pursuant to our 2017 Omnibus Incentive Compensation Plan. Assumptions used in the calculation of these amounts are included in Note 18, "Stock-based“Stock-based compensation,"” to our audited consolidated financial statements for the fiscal year ended December 31, 20202022 included in our Annual Report on Form 10-K. In accordance with the rules promulgated by the SEC, the amounts shown exclude the effect of estimated forfeitures. |

(2)

| (2)

The amount shown includes the pro-rated cash fees paid to Ms. Conigliaro for the number of weeks she served as Chair of the nominating and governance committee in 2022. |

(3)

| While he stillThe amount shown includes the pro-rated cash fees paid to Ms. Franklin for the number of weeks she served as a member of the nominating and governance committee in 2022.

|

(4)

| Mr. Nunnelly’s service on the board Mr. Scott received $72,000 annually, paid quarterly, for secretarial and office support services.ended on May 19, 2022. The amount shown reflects the prorated amount of this additional paymentpro-rated cash fees paid to him for the number of weeks that Mr. Scott served onhe was a member of the board in 2020.2022. |

The following table sets forth, with respect to each non-employee director, (i) the grant date of the RSU award granted during the

20202022 fiscal year, (ii) the aggregate number of the

Company'sCompany’s common shares subject to each such award, and (iii) the grant-date fair value of each such award, calculated in accordance with ASC Topic 718.

| | | | | | |

Director | | Grant Date of

RSUs | | Number of Common Shares Subject to RSUs Granted(1) | | Grant Date

Fair Value |

A. AGRAWAL | | May 20, 2020 | | 5,112 | | $174,984 |

S. CARTWRIGHT | | May 20, 2020 | | 5,112 | | $174,984 |

L. CONIGLIARO | | May 20, 2020 | | 5,112 | | $174,984 |

C. LINDSTROM | | May 20, 2020 | | 5,112 | | $174,984 |

J. MADDEN | | May 20, 2020 | | 8,617 | | $294,960 |

C. MORKEN | | May 20, 2020 | | 5,112 | | $174,984 |

M. NUNNELLY | | May 20, 2020 | | 5,112 | | $174,984 |

B. STEVENS | | May 20, 2020 | | 5,112 | | $174,984 |

M. VERDI | | May 20, 2020 | | 5,112 | | $174,984 |

| | A. AGRAWAL | | | May 19, 2022 | | | 4,829 | | | $199,969 | |

| | S. CARTWRIGHT | | | May 19, 2022 | | | 4,829 | | | $199,969 | |

| | L. CONIGLIARO | | | May 19, 2022 | | | 4,829 | | | $199,969 | |

| | T. FRANKLIN | | | May 19, 2022 | | | 4,829 | | | $199,969 | |

| | C. LINDSTROM | | | May 19, 2022 | | | 4,829 | | | $199,969 | |

| | J. MADDEN | | | May 19, 2022 | | | 7,726 | | | $319,934 | |

| | C. MORKEN | | | May 19, 2022 | | | 4,829 | | | $199,969 | |

| | B. STEVENS | | | May 19, 2022 | | | 4,829 | | | $199,969 | |

| | M. VERDI | | | May 19, 2022 | | | 4,829 | | | $199,969 | |

(1)

| (1)

| Except as otherwise indicated, theThe RSUs shown in this table vested in full on December 31, 2020,2022, and shares underlying such RSUs are issuable on December 31, 2021.

2023. |

23 2023 Proxy Statement | | | |

TABLE OF CONTENTS

| Director Compensation | |

| 2021 Proxy Statement |19

| |

The table below sets forth the aggregate number of common shares subject to unvested RSU awards held by each of our non-employee directors as of December 31,

2020.2022. There were no common shares subject to outstanding options held by our non-employee directors as of December 31,

2020.2022.

Director | | | Number of Common Shares

Subject to all Unvested Stock

Awards/Units(1) | |

| A. AGRAWAL | 5,548

| | 2,774 | |

| S. CARTWRIGHT | 4,455

| | 2,228 | |

| L. CONIGLIARO | | | — | |

C. LINDSTROM

| T. FRANKLIN | | | — | |

J. MADDEN

| C. LINDSTROM | | | — | |

C. MORKEN

| J. MADDEN | | | — | |

M. NUNNELLY

| C. MORKEN | | | — | |

| B. STEVENS | | | — | |

| M. VERDI | | | — | |

(1)

| The shares shown in this table are outstanding under sign-on RSU awards that were granted under our director compensation program in effect until December 31, 2019 and vest over a four-year period from the date of the director’s commencement of service. Effective January 1, 2020, we no longer grant sign-on RSUs to our new directors. |

24 2023 Proxy Statement | | | |

TABLE OF CONTENTS

| |

20 |2021 Proxy Statement

|

|

|

Executive Officer Compensation | | | |

EXECUTIVE OFFICER COMPENSATION

COMPENSATION DISCUSSION AND ANALYSIS

The compensation committee of the board of directors oversees our executive officer compensation program. In this role, the compensation committee reviews and approves all compensation decisions relating to our named executive officers. This Compensation Discussion and Analysis section discusses the compensation policies and programs for our Chief Executive Officer (referred to as our CEO), our Chief Financial Officer (referred to as our CFO) and our three

next most highly paid executive officers as determined under the rules of the SEC. Such individuals are referred to as our named executive officers.

Our named executive officers (also referred to as

"NEOs"“NEOs”) for

20202022 are:

| | |

N.V. "Tiger"“Tiger” Tyagarajan | | | President, Chief Executive Officer and Director | |

Edward J. Fitzpatrick

| Michael Weiner | | | Senior Vice President, Chief Financial Officer | |

| Balkrishan Kalra | | | Senior Vice President, Banking, Capital Markets, Consumer Goods, Retail, Life Sciences and Healthcare | |

| Darren SaumurSaumur* | | | Senior Vice President, Global Operating Officer | |

| Kathryn Stein | | | Senior Vice President, Chief Strategy Officer and Global Business Leader, Enterprise Services and Analytics | |

2020

*

| Mr. Saumur resigned from his position as Senior Vice President, Global Operating Officer of the Company, effective as of February 20, 2023. |

2022 Key Financial Highlights

In

2020,2022, we

faced a number of logistical and macroeconomic challenges related to the COVID-19 pandemic, including the need to quickly transition tens of thousands of employees across the globe to a virtual, work-from-home operating environment and extended economic uncertainty that resulted in delayed client decision-making as well as delays or cancellations of new projects or orders. All of these factors had an adverse impact on our bookings, revenues and operating income for the year. However, against this backdrop, our agility and culture of embracing change allowed us to rapidly adapt to meet client needs and pivot to new ways of working. We also focused on employee engagement and well-being during 2020, promoting employee training and re-skilling through our learning platform called Genome and providing internal opportunities through TalentMatch, our employee redeployment platform launched in 2020.Our financial results for the year, although lower than initially expected, reflect strong performance, including a 5% increase in total net revenues compared to 2019, in spite of the many challenges presented by the COVID-19 pandemic. We continued to followinvest for long-term growth following a strategy focused on delivering differentiated, domain-led solutions in a focused set of geographies, industry verticals and service lines. During the year we made acquisitions in twoWe sharpened our focus areas – experience-led transformation and data and analytics –on a portfolio of strategic clients and continued to invest in our existing digital capabilitiesemerging service lines. We also continued to invest in the learning and domain expertise,development of our employees to provide them with the critical skills needed for the future and to build their careers.

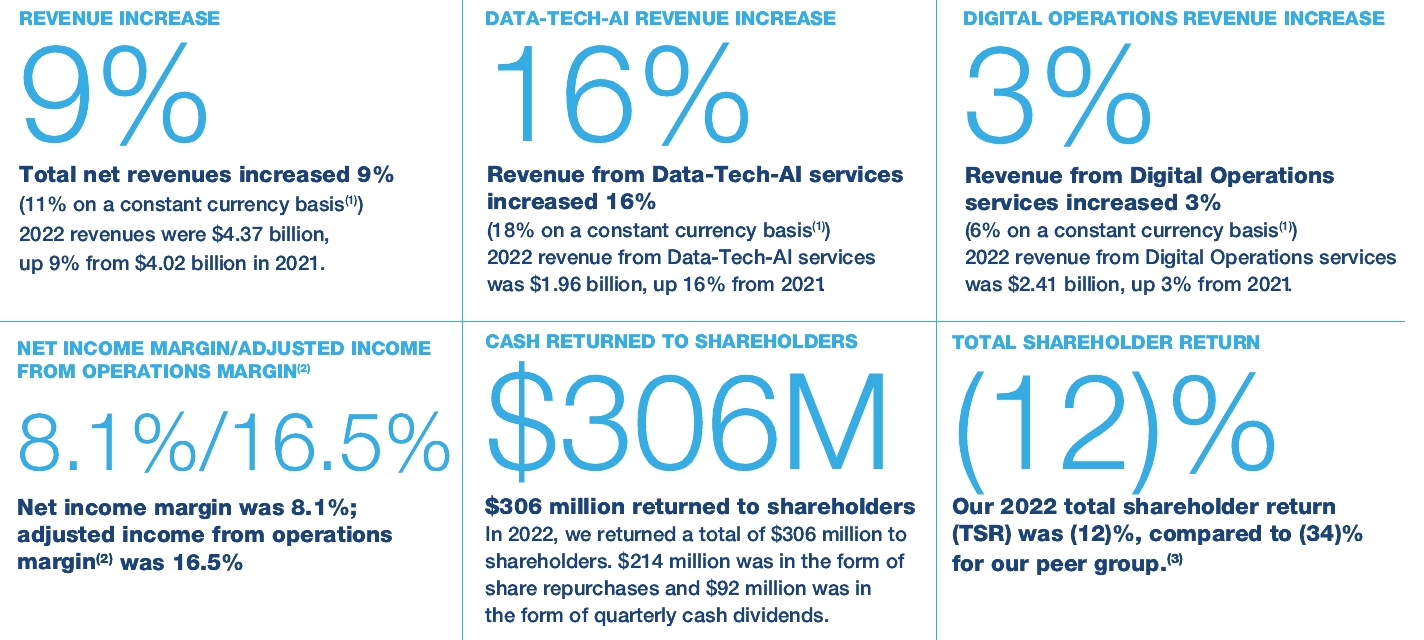

Select 2022 financial results are set out below.

(1)

Revenue growth on a constant currency basis is a non-GAAP measure and is calculated by restating current-period activity using the prior fiscal period’s

foreign currency exchange rates adjusted for hedging gains/losses in such period.

25 2023 Proxy Statement | | | |

TABLE OF CONTENTS

| Executive Officer Compensation | | | |

(2)

Adjusted income from operations margin is a non-GAAP financial measure used by our management for reporting, budgeting and decision-making purposes. Adjusted income from operations margin excludes certain recurring costs, namely stock-based compensation and amortization of acquired intangibles and, since April 2016, impairment of acquired intangibles. See Exhibit 1 to this Proxy Statement for a reconciliation of adjusted income from operations margin to the most directly comparable GAAP financial measure.

(3)

This is the peer group we use for purposes of Item 201(e) of Regulation S-K, consisting of the six companies that we believe are our closest reporting issuer competitors: Accenture plc, Cognizant Technology Solutions Corp., ExlService Holdings, Inc., Infosys Technologies Limited, Wipro Technologies Limited, and WNS (Holdings) Limited. The returns of the component entities of our peer group index are weighted according to the market capitalization of each company as of the end of each period for which a return is presented. The returns assume that $100 was invested on December 31, 2021 and that all dividends were reinvested.

Throughout 2022 there was significant economic and geopolitical uncertainty in

an effort to acceleratemany markets around the

business outcomesworld, including the markets in which we

can driveand our clients operate. Despite these challenges, our 2022 financial results reflect solid performance across all of our industry segments, highlighting the relevance of our Data-Tech-AI and Digital Operations services for our clients.

Our 2020 financial results include:

| |

Total net revenues increased 5%

2020 revenues were $3.71 billion, up 5% from $3.52 billion in 2019.

| Revenues from Global Clients increased 7%

2020 revenues from Global Clients (our clients other than the General Electric Company, or GE) were $3.3 billion, up 7% from 2019.

|

New bookings(1) performance

New bookings in 2020 were approximately $3.1 billion, down 20% from $3.9 billion in 2019.

| Diluted earnings per share increased 1%; adjusted diluted earnings per share(2)increased 3%

Diluted earnings per share were $1.57, up 1% from 2019, and adjusted diluted earnings per share were $2.12, up 3% from 2019.

|

| |

| 2021 Proxy Statement |21

|

| |

Income from operations increased 2%; adjusted income from operations(2) increased 5%

Income from operations in 2020 was $439 million, up 2% from 2019, and adjusted income from operations was $589 million, up 5% from 2019.

| Income from operations margin was 11.8%; adjusted income from operations margin(2) was 15.9%

Income from operations margin in 2020 was 11.8%, down 3% from 2019, and adjusted income from operations was 15.9%, in line with 2019.

|

Cash generated from operations was $584 million

Our cash generated from operations for the year ended December 31, 2020 was $584 million, up 36% from $428 million in 2019.

| $211 million returned to shareholders

In 2020, we returned a total of $211 million to shareholders. $137 million was in the form of share repurchases under our $1.75 billion share repurchase program and $74 million was in the form of quarterly cash dividends.

|

| (1)

| New bookings is an operating or other statistical measure and represents the total contract value of new client contracts and certain changes to existing client contracts to the extent such contracts represent incremental future revenue. Regular renewals of contracts with no change in scope, which we consider business as usual, are not counted as new bookings. For a more detailed description of new bookings, see "Item 7-Management's Discussion and Analysis of Financial Condition and Results of Operations—New Bookings" in our Annual Report on Form 10-K for the fiscal year ended December 31, 2020.

|

| (2)

| Adjusted income from operations/margin and adjusted diluted earnings per share are non-GAAP financial measures used by our management for reporting, budgeting and decision-making purposes. Adjusted income from operations/margin exclude certain recurring costs, namely stock-based compensation and amortization of acquired intangibles and, since April 2016, impairment of acquired intangibles. See Exhibit 1 to this Proxy Statement for a reconciliation of these non-GAAP financial measures to the most directly comparable GAAP measures.

|

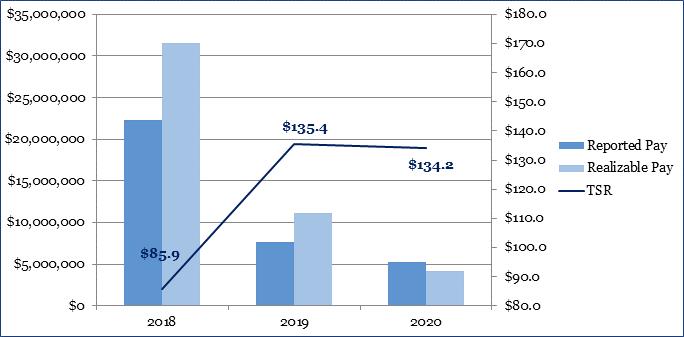

Due to the impacts of the COVID-19 pandemic on the global business and economic environment, Overall, while our financial results for 2020 resulted in below-target performance against several of the financial metrics in our 20202022 performance-based compensation plans was strong and significantly lowerwe achieved above-target performance under our 2022 performance share awards, bonus payouts to our executives in 2020 compared to 2019. The compensation committee initially setnamed executive officers were lower than target, reflecting the targets for our 2020 performance-based compensation plans in the first quarter of 2020 before the onsetstrength of the COVID-19 pandemic, at which time the potential impact of the pandemic was not in consideration. In June 2020, the compensation committee reevaluated our compensation plans for the year and in light of the impactplan design, leading to date and the further expected impact of the pandemic on our financial results for the year, the compensation committee amended our 2020 performance compensation plans to lower the threshold performance levels under each plana lower-than-target Company Multiplier, as well as the financial metrics in our named executive officers’ bonus scorecards. Loweringrigor of the threshold goals enabled potential achievement of at least a minimum level of vesting under the plans and provided an incentive for our management to continue to drive maximum performance under the circumstances. The target and outstanding performance levels for the financial metrics under each plan were not adjusted. Additionally, certain qualitative goals in our named executive officers’ bonus scorecards were added or revised to account for specific challenges presented by the COVID-19 pandemic as discussed below under “Compensation Components—Annual Cash Bonus—Bonus Scorecards.” Additionally, in recognition of the need to focus our management team on employee engagement and well-being given extended lockdowns and stay-at-home orders, in June 2020 the compensation committee approved the establishment of an additional bonus pool linked to an internal employee engagement metric, which had a maximum value of approximately 10% of the target bonus pool under our annual cash bonus plan. See “Compensation Components—Annual Cash Bonus—Bonus Pool” below for further information regarding this additional bonus pool.

If the threshold levels for the financial metrics under our 2020 performance-based compensation plans had not been adjusted mid-year, there would have been no payout under our annual cash bonus plan and a less than 17% vesting percentage under our long-term performance share awards for 2020. Based on our actual results for 2020 and after taking into account the revised threshold levels, our 2020 performance-based compensation plans were funded below target (88%) for our annual cash bonus plan and significantly below target (68%) for our performance share awards.

2022 individual scorecards.

We believe that our pay-for-performance program, which incentivizes higher-than-target growth in revenues,

adjusted operating income,

transformation services revenuesnet bookings and

netrenewal bookings while requiring a threshold level of

adjusted operating income margin, combined with the strength and resilience of our business model as well as a continued focus on our

strategy based on a set of industry verticals and service lines,strategic goals, contributed to our operational and financial achievements in

2020.

2022. | |

22 |2021 Proxy Statement

|

|

Compensation Objectives

The primary objectives of our compensation program for our executives, including our named executive officers, are to attract, motivate and retain highly talented individuals who are committed to our core values of courage, curiosity, incisiveness and integrity. Our compensation program is designed to incentivize and reward the achievement of our annual, long-term and strategic goals, such as growing revenues, improving operating margins and deepening client relationships. It is also designed to align the interests of our executives, including our named executive officers, with those of our shareholders by rewarding performance that exceeds our

target goals, with the ultimate objective of increasing shareholder value.

Our compensation committee is responsible for overseeing the goals and objectives of our executive compensation plans and programs. The compensation committee bases our executive compensation programs on the same objectives that guide us in administering the compensation programs for all of our employees globally:

Compensation is based on the individual’s level of job responsibility.

Compensation reflects the value of the job in the marketplace.

Compensation programs are designed to incentivize and reward performance, both on an individual and Company.

Company basis.Our compensation committee considers risk when developing our compensation program and believes that the design of our current compensation program does not encourage excessive or inappropriate risk taking. Our base salaries provide competitive fixed compensation. Under our annual cash bonus program, the target bonuses for our named executive officers range from 100% to

160%158% of their base salaries, and bonuses are payable based on attainment of multiple financial and non-financial short-term performance goals. We believe this structure, which is based on a number of different performance measures together with a meaningful cap on the potential payout, deters executives from focusing exclusively on the specific financial metrics that might encourage excessive short-term risk taking.

Our named executive officers are also granted performance share awards tied to the attainment of a number ofmultiple performance goals over the fiscal year and continued service over a three-year period. We believe that the three-year service vesting requirement under these awards encourages the recipients to focus on sustaining the Company'sCompany’s long-term performance. Our named executive officers also periodically receive option grants, which vest over a five-year period.period, and we grant restricted share units from time to time as sign-on grants. The value of our options and restricted share unit awards is tied to sustained long-term appreciation of our share price, which we believe mitigates excessive short-term risk taking. For 2023, in part in response to shareholder feedback we have received on our compensation practices, our compensation committee has approved changes to our long-term incentive compensation program. See the section titled “2022 Shareholder Feedback and Responsiveness” below for more information about these changes.

26 2023 Proxy Statement | | | |

TABLE OF CONTENTS

| Executive Officer Compensation | | | |

| | | |

| 2021 Proxy Statement |23

| | |

| |

| |

| |

| |

| | | |

| |

✘

WHAT WE

DON’T DO

| |

| |

| |

Executive Compensation Practices

We strive to maintain sound governance standards and compensation practices by continually monitoring the evolution of

"best“best practices.

"” As in prior years, we incorporated many best practices into our

20202022 compensation programs, including the following:

| | ✔ | |

WHAT WE DO

|

✓Align our executive pay with performance

| |

| | ✓ ✔

| | | Include a "clawback"“clawback” provision in our performance share awards | |

✓

| ✔ | | | Make payouts under our executive bonus plan only if threshold Company performance is met | |

| | ✓ ✔

| | | Set challenging performance objectives for our performance share awards and annual bonus | |

✓

| ✔ | | | Maintain a meaningful equity ownership policy for the CEO (6x base salary) and other NEOs (1x base salary) | |

| | ✓ ✔

| | | Regularly review the relationship between CEO compensation and Company performance | |

✓

| ✔ | | | Include caps on individual payouts in short- and long-term incentive plans | |

| | ✓ ✔

| | | Maintain an independent compensation committee | |

✓

| ✔ | | | Hold an annual "say-on-pay"“say-on-pay” advisory vote | |

| | ✓ ✔

| | | Prohibit hedging and pledging of Company common shares | |

✓

| ✔ | | | Retain an independent compensation consultant | |

| | ✓ ✔

| | | Place a substantial majority of executive pay at risk | |

✓

| ✔ | | | Regularly evaluate our share utilization and the dilutive impact of equity awards | |

| | ✓ ✔

| | | Mitigate the potentially dilutive effect of equity awards through our share repurchase program |

| | |

WHAT WE DON'T DO

| ✔ | | | Include restrictive covenants in equity award agreements, with a “clawback” of equity in certain circumstances | |

⨯

| ✔ | | | Maintain a three-year cliff service vesting schedule for annual performance share awards

| |

| | ✘ | | | Offer contracts with multi-year guaranteed salary or bonus increases | |

| | ⨯✘

| | | Provide guaranteed retirement benefits or contribute to non-qualified deferred compensation plans | |

⨯

| ✘ | | | Provide tax gross-ups (except with respect to the reimbursement of relocation expenses) | |

| | ⨯ ✘

| | | Provide excessive perquisites | |

⨯

| ✘ | | | Grant equity awards with "single-trigger"“single-trigger” change of control provisions | |

| | ⨯ ✘

| | | Pay dividends or dividend equivalents on unvested equity awards | |

⨯

| ✘ | | | Reprice or exchange underwater options without shareholder approval | |

| | ⨯ ✘

| | | Maintain special retirement plans exclusively for executive officers | |

⨯

| ✘ | | | Time the release of material non-public information to affect the value of executive compensation | |

| | ⨯ ✘

| | | Allow short sales or purchases of equity derivatives of our common shares by officers or directors | |

27 2023 Proxy Statement | | | |

TABLE OF CONTENTS

| Executive Officer Compensation | | | |

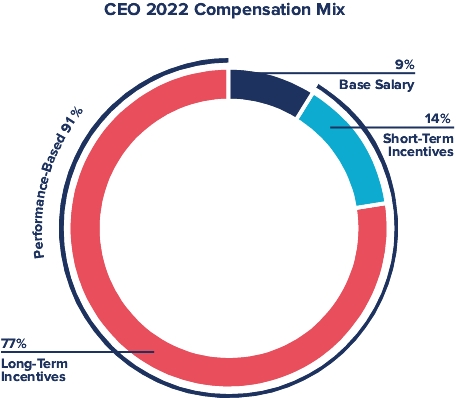

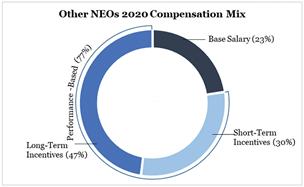

Pay for Performance Philosophy

The core objective of our executive officer compensation program is to align pay and performance. We believe that as an

employee'semployee’s level of responsibility increases, so should the proportion of total compensation opportunity that is structured in the form of long-term incentive opportunities. The compensation of our named executive officers for

20202022 reflects both our

20202022 performance and our commitment to providing executive compensation opportunities that are linked to Company performance, including progress on long-term strategic goals and shareholder value

creation, as well as the extraordinary impact of the COVID-19 pandemic.creation.

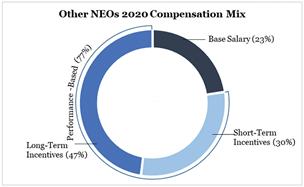

The material components of our compensation are (i) a fixed base salary and (ii) variable, performance-based compensation comprised of (A) short-term incentive compensation under our performance-based annual cash bonus program and (B) long-term incentive compensation in the form of equity awards, which

are generallyhave historically been granted as performance share awards on an annual basis along with periodic option awards. Our incentive plans are predominantly based on diverse

strategic financial metrics that